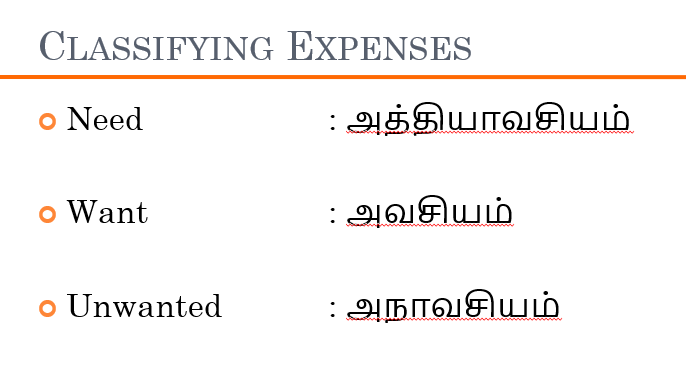

I extensively use the 3A formula for Expenses Classification when working with my clients. The 3As are based on the Tamil words Athiyavasiyam, Avasiyam and Anavasiyam meaning Needs, Wants and Unwanted respectively.

So how does this work?

Once the listing of the expenses is done using a budget sheet (more on this in another blog), we can start on the classification. I prefer to use three colours for the classification as in the traffic signals:

- Red → Unwanted (Anavasiyam)

- Yellow → Wants (Avasiyam)

- Green → Needs (Athiyavasiyam)

Then we can go about reducing the red in the budget sheet. But this leads to a fundamental question. How do I bin an expense among the 3 categories?

My Own Case:

I love popcorn. If I were to buy popcorn (Rs.300/- for a large bucket) at a mall everyday, it is UNWANTED. If I buy readymix popcorn sachets (Rs.25 to 40 per pack) and pop them at home, it will be a WANT. If I buy just the corn (Rs105/- per kg) and make popcorn at home for a whole month (for everyone in the family), it can be classified under NEED.

Practical Case on the 3A Formula

Here is a practical example from one of my workshops for blue collar employees: My company offers bus transport to the factory. But I prefer to use my bike as it gives me more flexibility. How do I classify this expense?

I would classify this bike expense as a want. The need was satisfied by the company bus. I WANT more flexibility so I am using my bike. The flexibility helps me to get some fresh vegetables, finish purchases, meet friends on the way home.

However using a car to go to work daily in this case will be UNWANTED, except in special cases.

The Special Case

The special case was with one of the participants who had due to a previous incident, a weak spine causing severe pain. The doctors had advised him to prevent shocks to the spine. This person was using his car to factory daily. This car expense for this person is now a NEED. Using the company bus or his bike are not options for this person due to the doctor’s advice.

So basically, we need to apply our thought to each expense while classifying them. But here is a formula using which anyone can quickly classify among the 3As.

Definition for the 3As

NEED → Does not stretch my budget; I /My Family members need / use the item fully

Examples for NEEDs are: groceries; vegetables and fruits; cable TV subscription; mobile phone connection; Education; fuel;

WANT → Does stretch my budget, but I can manage with a few months budget allocation or a reasonable number of EMIs; I / My Family members use the item fully

Examples for WANTs are: UPS for lights and fans; the slightly larger fridge; the oven for a weekly use; the slightly larger TV and that audio system; car that I use atleast twice a week (don’t count Sunday outings among this).

UNWANTED → Stretches my budget to a great extent, I need a huge set of EMIs; I / My Family members rarely use the item. I BASICALLY BOUGHT THIS FOR / BECAUSE OF OTHERS.

Examples for UNWANTED are: UPS for ACs; the triple door fridge for a 2 member family; the 105” TV in a 800square feet apartment; car used maybe once in a month

Think of those purchases and expenses that we do because somebody else has done so.

- My colleague has bought a car, so I buy one.

- She has upgraded her car; so I upgrade.

- On a birthday party they gave a gift for Rs.2000/-; so we should give back one for atleast Rs.2500/-.

- My neighbors have paid capitation fees and got admission for their son in a premier medical college, so my son will also go there (It does not matter that he loves electronics).

- My classmate has a 10 station gym in his house, so I will too (it does not matter that he is a professional bodybuilder and I am a painter).

I maybe exaggerating a bit with the last 2 examples. But I hope you got the idea.

Benefit of 3As Formula

I have seen my clients and workshop participants saving anywhere from 15% to even 30% of their budgets by classifying and focusing their attention to reduce the UNWANTED and the WANTs category items in their budget.

Most of us are living out of a Single Income but we have to manage so many Expenses. We all know how difficult it is to earn additional income. But rarely do we realize that a Rupee Saved is a Rupee Earned. Metaphorically a leaking ship, however fast it may go, is bound to sink. Plug your expenses first. Then spend time to earn more. By using the steps in the right order, the distance to Financial Wellness is shrunk.

Leave a Reply