Let us be clear about the plan:

This plan, Max life monthly income advantage plan is so called a non-linked, participating individual life insurance savings plan gives you a guaranteed monthly income and the choice of customize the plan, to fulfil every planned milestone of your life.

Plan features and benefits:

This plan offers you the flexibility with a choice of 15 variants, lump sum benefit on maturity, policy continuance benefit, guaranteed monthly income, comprehensive protection through riders, tax benefit, long term protection.

Death benefit:

Lump sum benefit: 11 times the annualised premium + underwriting extra premium if any.

Policy continuance benefit: All due premium if any coinciding or following the date of death of the life insured shall be waived off and the policy will continue as it is and income benefit & maturity benefit shall be payable to the beneficiary as and when due. Policy shall participate in future benefits.

Survival Benefit: Guaranteed monthly income = 1/12th of 10% of sum assured shall be payable as chosen for 10/20/30 years at each monthly anniversary commencing immediately after completion of the premium payment term.

Maturity benefit: Accrued compound reversionary bonus + terminal bonus if any, shall be payable on completion of the policy term.

Riders: Max life critical illness and disability rider, Max life term plus rider, Max life accidental death and dismemberment rider, Max life covid-19 one year term rider.

Source: Monthly Income Scheme: Best Investment Plan for Monthly Income | Max Life Insurance

Should you buy this plan?

Definitely NO

Below listed are some reasons why you should not buy this plan?

Low returns.

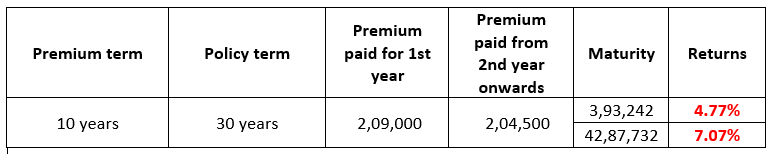

Max Life Monthly Income Advantage gives you very low returns of 4.77% to 7.07%.

Will these returns benefit your future? Definitely NO.

Considering premium of 2 lakhs annually for premium payment term of 10 years and the policy term of 30 years. The GST of 4.5% is stated for 1st year and 2.25% is stated for 2nd year and for the following years is included in this calculation. The returns are calculated as follows.

Non-guaranteed returns.

If we choose this plan, we will get only low returns and that too is not guaranteed.

If there is a rise in inflation, we get even low returns than what we get now.

Live cover is not meaningful.

The life cover provided under this plan is too low when compared to the premium paid.

It will not make any sense to family members, in case of absence of the bread-winner.

Summary:

Team financial wellness suggest you not choose this plan.

This is a non-linked, non-participating individual life saving insurance plan which will never satisfy your financial needs. These returns are not guaranteed even though it not guaranteed we get only low returns. Only if there is best profit for the company we get returns and it is also very low. This plan benefits our life only for a certain period and not the whole life. The life cover is inconsequential and this plan doesn’t offer emergency cash requirements.

Leave a Reply