About SBI Life -Smart Platina Assure?

SBI Life – Smart Platina Assure, an individual, non-linked, non-participating life endowment assurance savings product which assures guaranteed returns with an advantage of paying premiums for a limited term. Let us look at the plan features:

- Get Life cover along with Assured return

- Enjoy Guaranteed Additions of 5.25% to 5.75% at the end of each policy year

- Pay for just 6 or 7 years and enjoy the benefit throughout the policy term of 12 or 15 years respectively

- Option to choose Monthly or Yearly premium payment frequency, as per convenience.

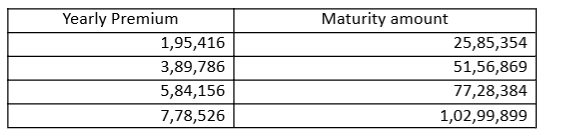

- In the below table tabulates premiums paid for term of 7 years and maturity received at the 15th year.

For further details visit: Endowment Assurance Policy India, Savings Plan | SBI Life – Smart Platina Assure

Team Financial Wellness suggests not to choose SBI Life – Smart Platina Assure

You will never be a champion if you choose this plan as said by SBI Life. As an individual or end user you get easily struck up with few striking words guaranteed returns, Tax benefit and maturity benefit. These are all colorful selling concept of smart platina assure plan. Team Financial Wellness has analyzed the plan and formulated the outcome in the following discussion.

Here is why you should not choose this plan?

Part 1: Return generated is insignificant.

The company claims that the plan will generate 5 to 5.75% returns for long term of 15 years. Is this enough?

Definitely No.

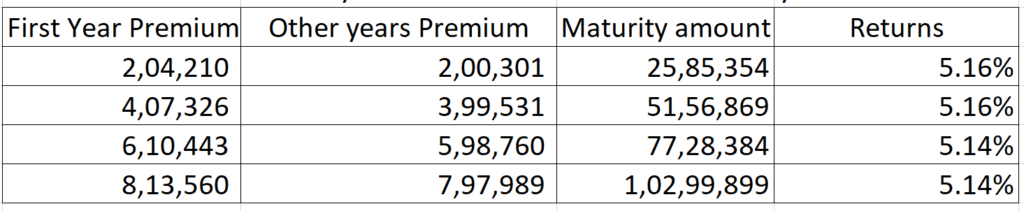

The below table provides the actual returns, calculated based on the maturity values.

Premium Payment term is 7 years and maturity term 15 years. For the first year premium, GST is levied at 4.5% while for subsequent years, it is levied at 2.25%.

Only one word “guarantee”, completely hides that you are being paid the bare minimum.

If you factor inflation of 7.2% (source: rbi.org.in) returns is -1.8%.

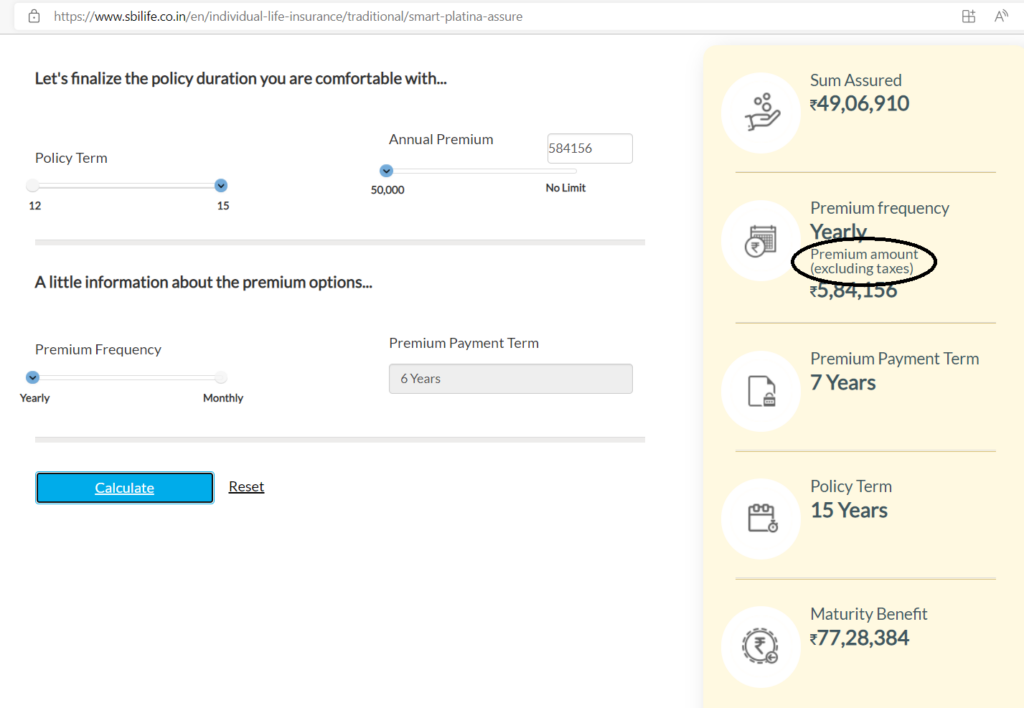

Part 2: The Life Cover is not meaningful.

The life cover provided under the plan is too low relative to the premium paid.

The cover will not make any sense to the family members, in case of absence of the bread-winner.

Source:Endowment Assurance Policy India, Savings Plan | SBI Life – Smart Platina Assure.

Part 3: The plan does not support emergency cash requirement.

This plan is said to be Saving plan, but savings are for emergency need. Long term endowment plan will never satisfy your additional urgent requirements. This is because you can access your money only as a loan in case of emergency. You pay for getting your own money???(sic)

The plan is a classic case for asset class mismatch.

Summary:

Team Financial Wellness recommends not to choose SBI life Smart Plat plan as,

- Returns generated is very low and negative (-1.8%) if factored in for inflation.

- Life cover is trifling and does not support family in case life assured is lost.

- Does not support emergency cash requirement. You need to take a loan.

Team Financial Wellness strongly suggest you to stay away from this Plan.

© Copyright of Karthikeyan Jawahar; 2021 and beyond. All Rights Reserved. Any modification or use for commercial purpose without prior written consent by Karthikeyan Jawahar is prohibited.

Leave a Reply