Max Life Savings Advantage Plan – Will this plan satisfy my future financial needs?

Let us be clear about the plan:

Max Life Saving Advantage plan is a non-linked, participating, individual life insurance savings plan which is supposed to help you to grow your systematic savings to build a corpus to address all your life stage needs while providing coverage against risk to take care of your loved ones in case of an emergency.

Plan Features and Benefits:

There is Flexibility to choose premium payment terms and policy terms as per your need, guaranteed additions, death benefit that increases post 10 policy years, maturity benefit, settlement and commutation benefit, and tax benefit and terminal illness benefit. The guaranteed and non-guaranteed benefit is applicable only if all premiums are paid. The guaranteed and non-guaranteed benefit is applicable only if all premiums are paid.

Maturity Benefit: 110% of guaranteed sum assured on maturity + accrued guaranteed additions + accrued paid up additions if any + terminal bonus if any.

Death Benefit: Single pay variant and limited pay variant if there are demises before the completion of 10 policy years: guaranteed death benefit, accrued guaranteed additions, accrued paid up additions if any and terminal bonus if any is payable. If there are demises after the completion of 10 policy years: 110% guaranteed death benefit, accrued guaranteed additions, accrued paid up additions if any and terminal bonus if any is payable.

Riders’ Benefit: Max life term plus rider. Max life accidental death & dismemberment rider. Max life waiver of premium plus rider.

Bonus: Annual bonus: paid up additions. Premium offset. Paid in cash. Terminal bonus: Additional bonus paid only once, on earlier death, surrender or maturity, provided the policy has been in force for at least 5 years.

Source: Savings Advantage Plan (maxlifeinsurance.com)

Will this plan satisfy my future financial needs?

Definitely “NO“. We have 3 reasons for this:

- Return generated is INSIGNIFICANT.

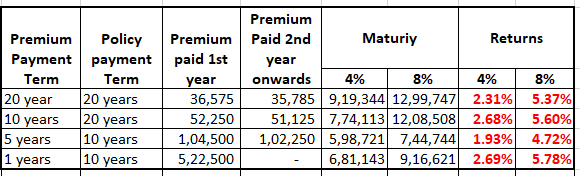

Max Life Saving Advantage plan provided you very low returns of 1.93% to 5.78%.

Do you think 1.9% returns will satisfy your financial needs? NEVER

Considering various premium amount, with different policy term and premium payment terms actual returns has been calculated. For first year premium, GST is levied at 4.5% while for subsequent years, it is levied at 2.25%.

The above-mentioned table shows the actual returns

Is Rs 10,000 today same as Rs 10,000 after 20 years? Of course not.

You are paid bare minimum returns of 1.93%. If you factor in for inflation returns generated are negative (-).

2. The Life Cover is Not Meaningful.

The life cover provided under the plan is too low relative to the premium paid.

The cover will not make any sense to the family members, in case of absence of the bread-winner.

3. The plan does not support emergency cash requirement.

Any long term endowment plan will never satisfy your urgent / emergency requirements. The best that one can do is to take a loan on the policy. Does it make sense to pay interest to access you own money???

Summary:

The Max Life Savings Advantage Plan is a non-participating life insurance savings plan that never helps with future needs. Even though the company offers you bonuses and shares in the company’s profits, we gain meager returns (negative returns if factored in for inflation). Life cover is trifling and does not support family in case the life assured is no more. This plan does not fund for emergency needs.

Team Financial Wellness strongly suggest you to stay away from this Plan.

This article was supported by Ms.M. Sumathi BSc, MBA, Business Development Executive, Financial Wellness Forever & Ms.Sandhya, Intern, Management Student, GRG School of Management Studies

©Copyright of Karthikeyan Jawahar; 2021 and beyond. All Rights Reserved. Any modification or use for commercial purpose without prior written consent by Karthikeyan Jawahar is prohibited. This article is for knowledge sharing purpose and should not be deemed as an implementation plan. Contact Team Financial Wellness for a customized plan implementable for you.

Leave a Reply