About the plan:

Aviva New Family Income Builder plan is so called a non-linked non-participating life insurance plan that doubles your money. It is said to be a savings plan combined with the protection-oriented plan that assists you financially by guaranteeing returns in the form of regular payouts for 12 years. These regular payouts are passed onto your family in case of your untimely death. This plan provides guaranteed income for self and for family in case of your death.

Plan benefits and feature:

Death benefit:

10 times of the annualized premium, or 105% of all the premiums paid (excluding taxes and extra premiums, if any) as on date of death, or Maturity Sum Assured, Sum Assured of the Policy.

Maturity benefit: 12 annual instalments of “1.5 times the annual premium” shall be paid at the end of each year during the Pay-out Period. A lumpsum amount of “6 times the annual premium” shall be paid at the end of the Pay-out Period. An additional Guaranteed Terminal Benefit, depending upon age at entry, is paid at the end of the Premium Payment Term.

you will be provided with the death and maturity benefit only if all the due premiums have been paid.

Guaranteed terminal benefit: Aviva New Family Income Builder also provides guaranteed terminal benefits The Guaranteed Terminal Benefit depends on your entry age.

Source: Investment Option – Long Term Investment Plan in India – Aviva Life Insurance (avivaindia.com)

Should you buy this plan?

Definitely NO.

Here are the reasons why you should buy this plan ?

Poor returns:

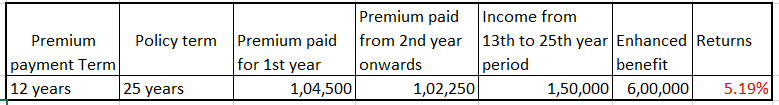

The below table provides the actual returns, calculated based on the values in the Boucher.

Considering Rs.1lakh as an annualized premium for 12 years. This plan provides regular income for 12 years and terminal benefit at the end of 12th year after the policy term gets over. The GST is stated as 4.5% for the 1st year and 2.25% for the 2nd year and for the following year is calculated.

Actual returns gained from this plan is 5.19%. If there is a rise in inflation your returns will be still lower or maybe in negative. Considering premium paid returns are relatively low, even though you receive annual income .

The Life Cover is not meaningful.

The life cover provided under the plan is too low relative to the premium paid. The cover will not make any sense to the family members, in case of absence of the bread-winner.

Summary:

Team financial wellness suggest you not to choose this plan.

This plan, Aviva New Family income builder will never satisfy your future needs. Here the returns generated are very low. The life cover offered in this plan is inconsequential. So, team Financial Wellness suggest you not to choose this plan.

© Copyright of Karthikeyan Jawahar; 2021 and beyond. All Rights Reserved. Any modification or use for commercial purpose without prior written consent by Karthikeyan Jawahar is prohibited.

Leave a Reply